Medicare Advantage plans are a popular alternative to Medicare provided by commercial insurers. However, Medicare Advantage has both advantages and disadvantages.

Some Medicare Advantage plans provide long-term savings, plan flexibility, and improved treatment, but others might result in fewer provider alternatives, extra expenses, and lifestyle issues.

This article will discuss the pros and cons of Medicare Advantage Plans, as well as how to enroll in Medicare for yourself or a loved one.

How Does Medicare Advantage Plan Work?

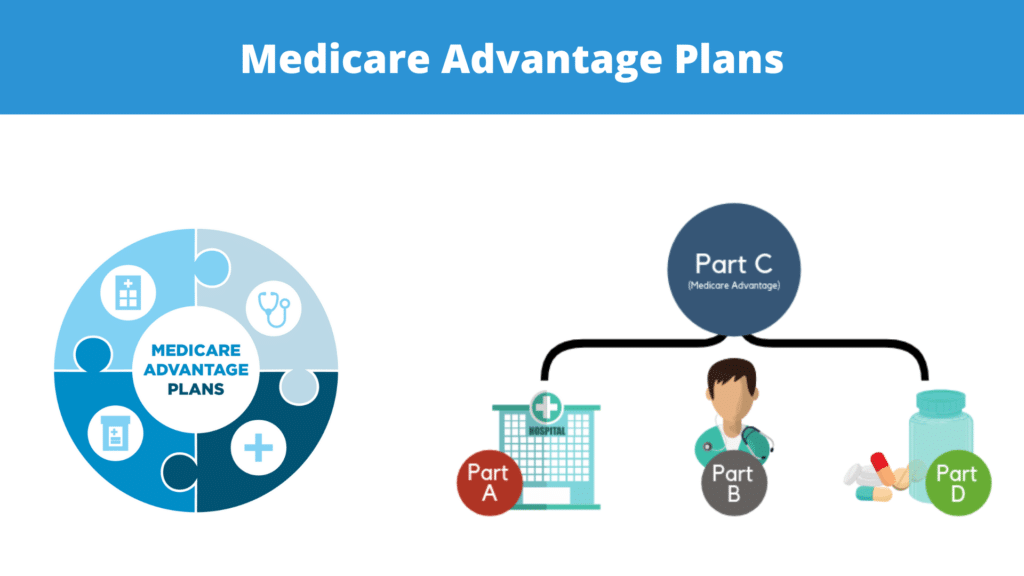

Private insurance firms sell Medicare Advantage Plan, often known as Medicare Part C. They combine traditional Medicare coverage (Medicare Parts A and B) and frequently provide extra benefits.

Numerous Medicare Advantage Plans include the following advantages:

- Hospitalization

- Certain in-home medical services

- Hospice care

- Doctor’s visits

- Pharmaceutical coverage

- Preventative care

Medicare Advantage Plan Types

There are several Medicare Advantage plan options available, including:

- Organization for Health Maintenance (HMO): HMO plans employ in-network physicians and need specialist referrals.

- Favorable Supplier Organization (PPO): Different fees are charged for in-network and out-of-network services under PPO plans.

- Individual Fee-For-Service (PFFS): PFFS plans are unique payment arrangements that enable providers with flexibility.

- Specialized Planning (SNPs): SNPs reduce the long-term expenses associated with chronic illnesses.

- Health Care Spending Account (MSA): MSA plans are high-deductible health plans linked with medical savings accounts.

Medicare Advantage Plan Advantages

There may be advantages to selecting a Medicare Advantage Plan as opposed to traditional Medicare.

These are as follows:

1. Convenient Coverage Choices

Original Medicare provides solely hospital insurance and medical insurance. You must purchase Medicare Part D for prescription medication coverage and Medigap for supplementary coverage if you need extra coverage.

A Medicare Advantage plan consolidates all of your coverage options into a single, simple plan.

2. Individualized Plan Formats

Medicare Advantage Plans offers many plan options based on your individual needs.

For instance, if you have a chronic illness, an SNP Advantage plan can assist with your medical expenses. If you desire provider independence, a PPO or PFFS plan may better suit your needs.

Many Medicare Advantage Plans include supplemental services such as dental, vision, and hearing.

3. Monetary Savings Possibilities

Numerous Advantage Plans lack premiums and provide low or nonexistent deductibles. The majority of Medicare Advantage Plans restrict the maximum amount of out-of-pocket expenses you’ll incur throughout the plan year.

Switching to a Medicare Advantage plan might save you money on laboratory tests and medical equipment. You may save even more on healthcare services offered by your HMO network if you choose for a Medicare HMO plan.

4. Coordination of Health Care

Numerous Medicare Advantage Plans provide coordinated care.

This indicates that your healthcare professionals actively coordinate your treatment across a variety of healthcare services and medical specializations.

This guarantees that you have a healthcare team and prevents avoidable costs and complications, such as medication interactions.

Disadvantages of Medicare Advantage Plans

While the majority of Medicare Advantage enrollees are happy with their coverage, Medicare Advantage plans may have certain drawbacks compared to traditional Medicare.

1. Confined Service Suppliers

If you select one of the more common Medicare Advantage Plan types, such as an HMO, you may be restricted in your choice of providers. Generally, if you pick an out-of-network provider with these plans, you will incur greater expenses.

Other plan types do offer greater provider choice, but they may have higher premiums and expenses, including as copayments and deductibles.

2. Complicated Plan Options

Using Medicare’s locate a plan tool, you will discover that, depending on your ZIP code, there are several Medicare Advantage Plan possibilities. All these possibilities might be daunting to some individuals.

3. Additional Coverage Fees

Original Medicare requires payment of a premium, deductible, and coinsurance for both Parts A and B, in addition to any Part D or Medigap expenditures.

Medicare Advantage Plans frequently merge these expenses, although extra fees may apply.

For instance, most Medicare Advantage Plans include prescription deductibles and copayments for visits to specialists.

4. State-specific Protection

Original Medicare provides nationwide coverage with the same benefits. However, Medicare Advantage Plans may only provide coverage in particular service regions.

If you relocate to a new service area, your current Medicare Advantage plan may no longer be accessible.

How to Choose an Optimal Medicare Advantage Plan

Choosing the Medicare Advantage Plan that best meets your requirements might be difficult. When selecting a Medicare Advantage plan, consider the following:

Cost Spent on Healthcare

How much did I spend on healthcare in the past year or years?

This may help you calculate your budget, including how much you can spend on premiums and out-of-pocket expenses. Some plans provide zero-dollar premiums and deductibles, whilst others may charge several hundred dollars.

Preferred Prescription Medications

Which prescription medications do I take or will I require?

Find an Advantage Plan that offers prescription drug coverage or purchase a Part D plan if you use medicine. Verify if your drugs are covered by a plan’s drug list (formulary) by conducting a thorough search.

Forms of Insurance

What forms of insurance do I require?

Numerous Advantage plans offer dental, vision, and hearing care. You can contact providers to learn more about their plans.

The Ailments

What ailments do I have, and what are my long-term healthcare requirements?

Over 40% of Americans suffer from chronic health issues. You should also assess which plan best meets your long-term medical needs.

Healthcare Provider Participation

Does my healthcare provider participate in Medicare or an HMO network? If maintaining your existing healthcare provider is vital to you, you must learn which Medicare plans they accept or participate in.

CMS Rating

What is the CMS rating of the plans that I am contemplating?

The Centers for Medicare & Medicaid Services (CMS) assess the quality of care delivered by Medicare Advantage and Part D plans using a Five-Star Rating System.

The CMS star ranking evaluates a variety of factors, including treatment of chronic illnesses, availability of care, member experience and complaints, customer service, and prescription prices. Every year, CMS provides its star ratings.

Final Thoughts

Medicare Advantage Plan has several advantages over traditional Medicare, including easy coverage, different plan alternatives, and long-term savings.

There are other downsides, including as provider restrictions, increased prices, and lack of trip coverage.

Regardless of whether you pick traditional Medicare or Medicare Advantage, it is essential to evaluate your healthcare requirements and Medicare alternatives before selecting a plan.